Are you hoping to find 'efficient market hypothesis'? Here you can find questions and answers about the issue.

Table of contents

- Efficient market hypothesis in 2021

- Efficient market hypothesis louis bachelier

- Application of efficient market hypothesis

- Efficient market hypothesis pdf

- Efficient market hypothesis example

- Efficient market hypothesis examples

- Efficient market hypothesis fama

- Efficient market hypothesis assumptions

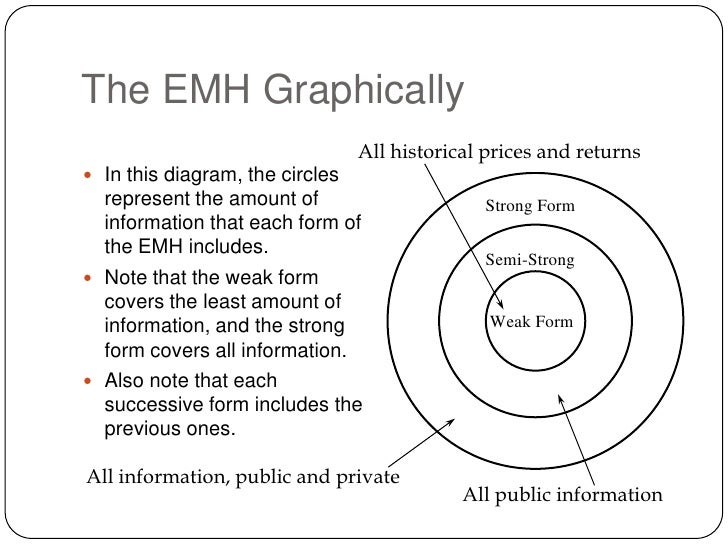

Efficient market hypothesis in 2021

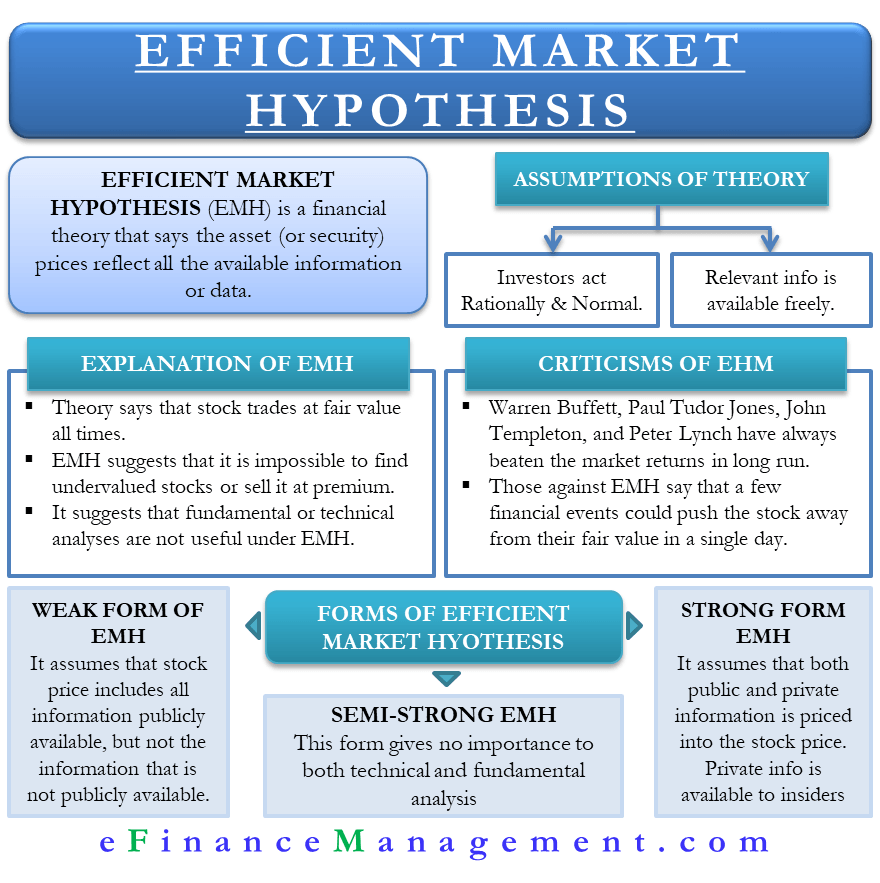

This image demonstrates efficient market hypothesis.

This image demonstrates efficient market hypothesis.

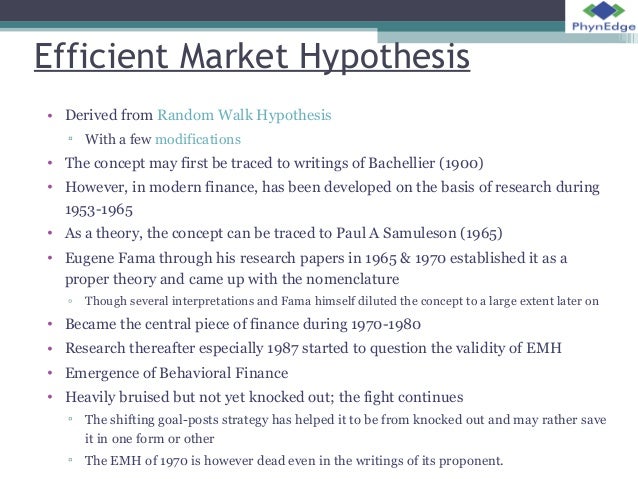

Efficient market hypothesis louis bachelier

This image representes Efficient market hypothesis louis bachelier.

This image representes Efficient market hypothesis louis bachelier.

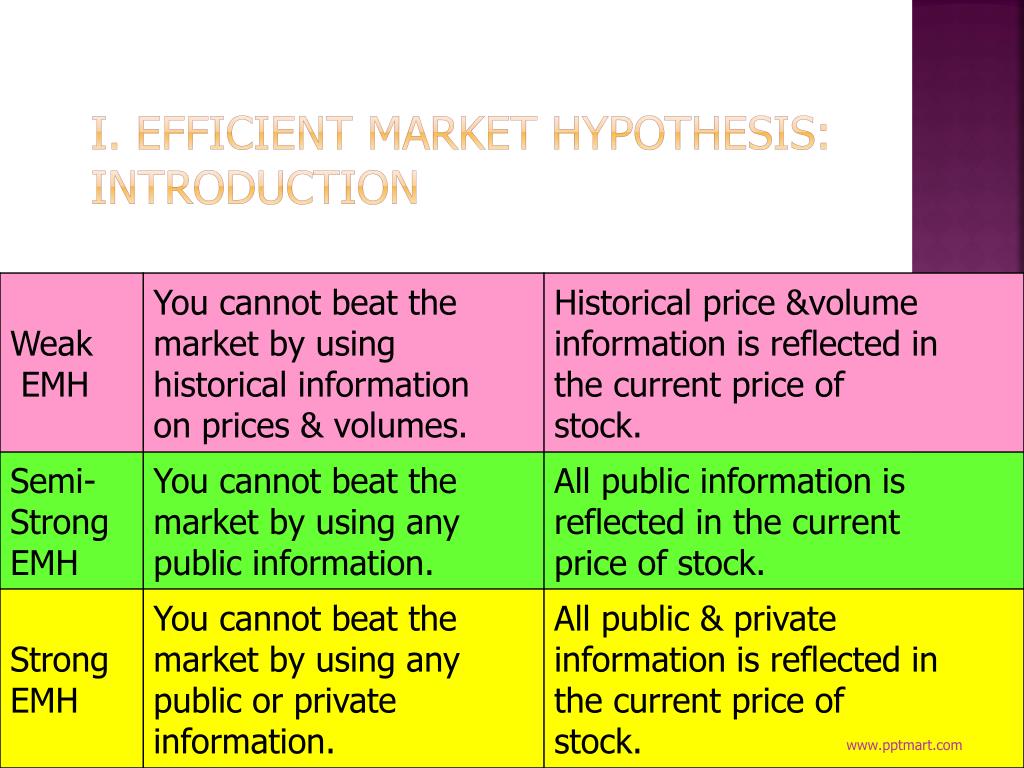

Application of efficient market hypothesis

This image demonstrates Application of efficient market hypothesis.

This image demonstrates Application of efficient market hypothesis.

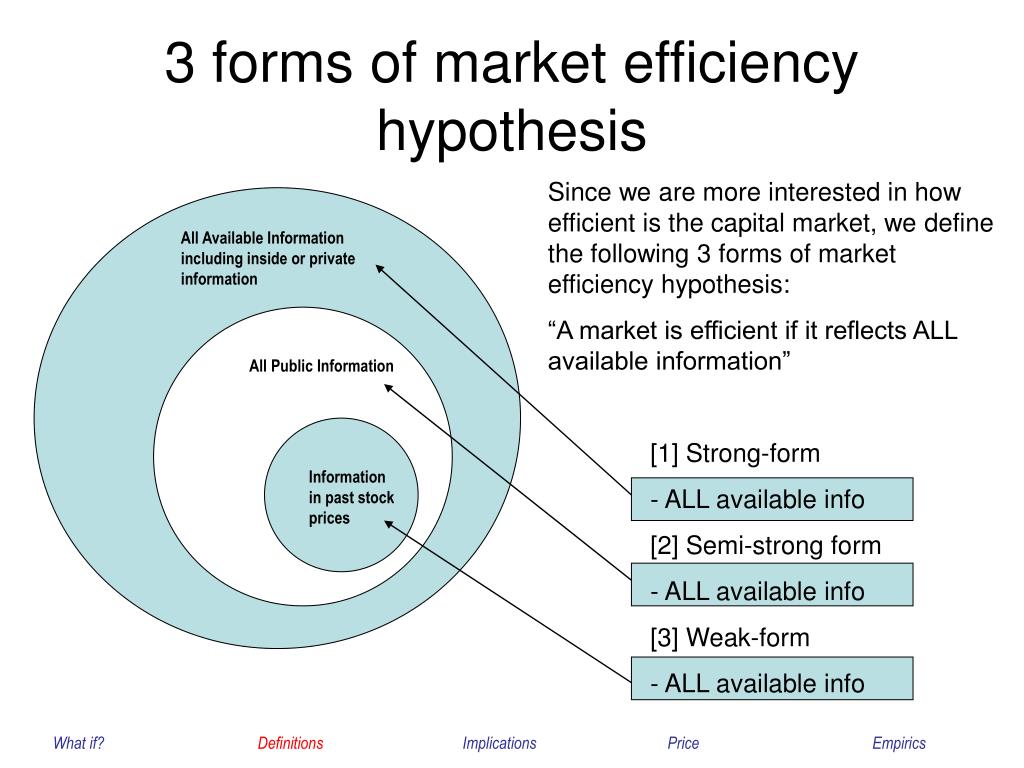

Efficient market hypothesis pdf

This image illustrates Efficient market hypothesis pdf.

This image illustrates Efficient market hypothesis pdf.

Efficient market hypothesis example

This picture demonstrates Efficient market hypothesis example.

This picture demonstrates Efficient market hypothesis example.

Efficient market hypothesis examples

This picture illustrates Efficient market hypothesis examples.

This picture illustrates Efficient market hypothesis examples.

Efficient market hypothesis fama

This image shows Efficient market hypothesis fama.

This image shows Efficient market hypothesis fama.

Efficient market hypothesis assumptions

This picture demonstrates Efficient market hypothesis assumptions.

This picture demonstrates Efficient market hypothesis assumptions.

Who are some people who dispute the efficient market hypothesis?

Investors, including the likes of Warren Buffett, George Soros, and researchers have disputed the efficient-market hypothesis both empirically and theoretically.

Is the efficient markets hypothesis the same as the random walk theory?

Understanding the Efficient Markets Hypothesis. Fama’s investment theory – which carries essentially the same implication for investors as the Random Walk Theory. Random Walk Theory The Random Walk Theory or the Random Walk Hypothesis is a mathematical model of the stock market. Proponents of the theory believe that the prices of.

How is the efficient market hypothesis related to the stock market?

The efficient-market hypothesis ( EMH) is a theory in financial economics that states that asset prices fully reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information.

What can make a market more efficient EMH?

Neither fundamental nor technical analysis can be used to achieve superior gains. Weak efficiency - This type of EMH claims that all past prices of a stock are reflected in today's stock price. Therefore, technical analysis cannot be used to predict and beat the market. What can make a market more efficient?

Last Update: Oct 2021